California Vacation Rental Insurance

Short term rental insurance for vacation rental properties in California

Do you own or manage a short term vacation rental property in California? If you answered yes, this information is specifically for you. Here is everything you need to know about short term rental insurance for vacation rental properties in California.

Why you should consider InsuraGuest for your California vacation rental insurance provider

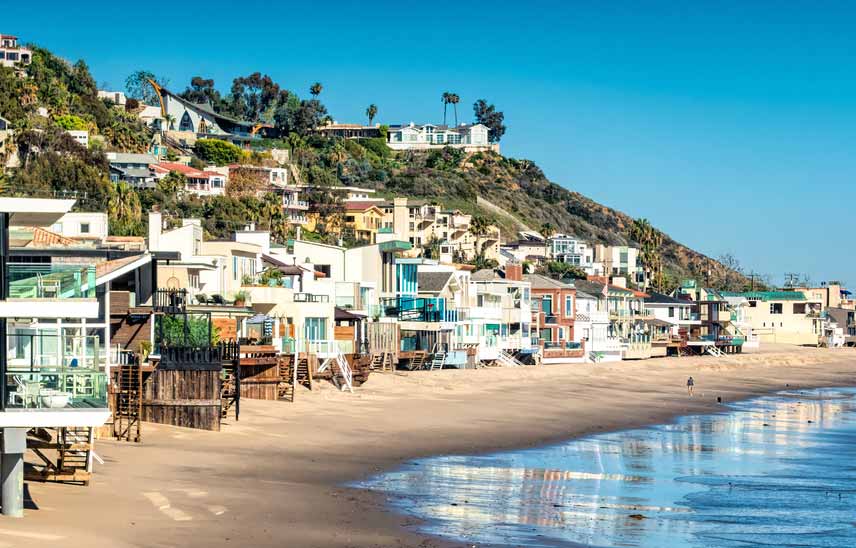

California’s booming tourist industry makes it the ideal locale for owning a short term rental property.

Whether your rental property is near the shores of Pismo, two blocks from the Hollywood walk of fame, or within sight of the northern redwoods, demand for short term vacation rentals in California is high.

This is great for short term vacation property owners—until it isn’t.

More guests coming through your vacation rental property means the chances of an accident occurring, like property damage, liability for injuries to guests are higher. You need short term vacation rental insurance that is specifically designed for California so you’re protected.

But many insurance companies offer short term vacation rental coverage, nationwide and locally in the Golden State. What makes InsuraGuest the best vacation rental insurance provider for your short term rental property in California?

InsuraGuest makes short term rental insurance simple while also providing great coverage for guests getting injured, property damage. Both you and your guests can enjoy peace of mind, resulting in more good reviews to increase the profitability of your California vacation rental business.

1. Simplicity

We believe purchasing short term vacation rental insurance in California should be as simple and straightforward as possible. We understand the unique needs and concerns of California short term rental property owners and have tailored our process to be as user friendly and hassle free as possible.

Whether you’re signing up for an STR policy for the first time or filing a claim, InsuraGuest makes the process easy and fast.

Unlike other California insurance companies offering a broad range of policies spread across multiple industries, like home, commercial, and health insurance, InsuraGuest specializes solely in providing the best vacation rental insurance in California.

Signup is quick and easy and STR coverage is instant. In the event of a claim, payouts are typically handled within 72 hours, without making you jump through a ton of hoops.

InsuraGuest strives to provide the simplest, most streamlined vacation rental insurance experience for California short term vacation property owners and their guests. So you can focus on enjoying your time with the peace of mind that comes from knowing your vacation property is protected.

2. Lower Costs

At InsuraGuest, we're committed to helping vacation rental property owners in California save big on their short term rental policies.

While many short term rental insurance companies promise they will save you money, we actually deliver on that promise, even after the ink has dried. How? By helping you share insurance costs with guests.

The process works like this: Using your favorite property management system or your listing service, we help create and automate a small nightly insurance fee of a few dollars for each guest reservation.

Our data shows guests would much rather pay a few dollars for insurance protection than pay for a traditional security deposit, which only benefits vacation property owners, not the guests.

But with InsuraGuest, both parties are covered, resulting in a better guest experience, more positive reviews, and more bookings for your California short term rental property.

Here’s an example of how it works: Suppose your vacation rental property in California has an occupancy rate of around 70% to 80%, or roughly 21 days per month. By adding an InsuraGuest fee of just $3 per night, you would add about $63 to your bottom line each month (21 days x $3 = $63/mo).

Using these averages, if you were to opt for our $69 per month subscription model (with up to $10,000 in coverage), your monthly insurance costs would essentially be net $0.

$10,000 of coverage for you and your guests for $0/mo? Yep, you read that right. Want to see how it works? Get a demo

3. Guest Injury Protection

From our experience, short term vacation rental property owners in California are mostly concerned about potential lawsuits from guest injuries—and for good reason. Even with the best precautions in place, accidents can still happen.

Thankfully, InsuraGuest helps you protect yourself, your vacation property, and your guests, with vacation rental liability insurance, or more specifically, short term rental insurance for California vacation rental properties.

If held liable, a guest getting injured during their stay can mean major trouble for your short term vacation rental business. But with guest injury insurance for your vacation rental property, you're covered against expensive medical bills.

Even if the injury wasn't your fault, guests can still sue you, and legal fees can add up quickly. With InsuraGuest, you don't have to worry about being held liable, because we cover up to $25,000 in guest injury medical bills, no matter who’s at fault.

Another factor to consider is that filing a claim against your homeowner's insurance policy usually increases your premiums later on. Not with InsuraGuest, in fact, for less than a cup of coffee a day, you can avoid this risk and protect yourself and your guests with California's best short term rental insurance provider.

4. Property Damage Protection

Second to guests getting injured during their stay is the concern of having your California short term vacation property damaged by guests.

Remember, when renting out your short term vacation property on platforms like AirBnB, VRBO, and other listing sites, you're entrusting your space to strangers who may not treat it with the same care as you would.

California vacation rental property owners must be prepared for the risk of accidental property damage by guests.

That's why having short term rental insurance in California is crucial for protecting against unexpected damages.

With a California STR policy from InsuraGuest, you can rest easy knowing your property and its contents are protected.

Let us handle the details so you can focus on creating a positive guest experience and getting more great reviews.

5. No Contract

California vacation rental property owners can pick from two InsuraGuest plans with different levels of coverage through a subscription-based model.

The $69/month plan provides up to $10,000 in coverage, while the $99/month plan provides up to $25,000 in coverage.

Signing up for InsuraGuest is a breeze and can be done quickly online by providing your California vacation rental property address, payment details, and basic information.

InsuraGuest provides instant coverage, which means you don't have to wait for a long process of investigation or property appraisal.

Plus, our short term rental insurance policy has no long-term contracts, making it easy to cancel or modify your subscription as needed.

6. Only Pay For When You Need It

We understand the struggles of short term vacation property owners in California, that business can boom one month but fall flat in another. If your vacation rental business experiences seasonal highs and lows, you’ll appreciate that with InsuraGuest, you only pay when you need coverage.

Our innovative system allows you to pause service when your short term vacation property is vacant, and then resume your STR policy again when guests arrive.

Just log in to your account, select the subscription to pause, and click the Pause link. With that, your insurance coverage will be instantly enabled. To resume, simply log back in and click the Start link.

This pay-as-you-need process means you're not paying for vacation rental insurance when guests aren’t staying at your property; you're only paying for the days and weeks when you require coverage.

7. Make Your Vacation Rental Business More Profitable

By adding a small, automatic nightly insurance fee through your property management system with InsuraGuest, your guests will feel safe, secure, and happy knowing they are protected. Happy guests are more likely to leave great reviews, which make your California short term vacation rental business more profitable.

What’s more, sharing the costs of STR insurance with your guests helps offset your subscription costs and improves the revenue of your California vacation rental business.

Additionally, we’ve found that most guests dislike paying a security deposit as it can make them feel uneasy, that they may not get it back. But by automating a nightly insurance fee of a few dollars, your guests will enjoy a more comfortable experience, something they are likely to share in their great review.

8. Works With Your Favorite Property Management System

InsuraGuest partners with the leading property management system (PMS) companies in the vacation rental property industry. These systems allow short term vacation property owners to manage bookings, reservations, and more all in one location.

By partnering with PMS companies, our software integrates seamlessly with theirs, allowing you to easily and quickly add a nightly insurance fee of a few dollars and boost your vacation rental business.

The integration process is hassle-free, simply sign up for an InsuraGuest subscription and, using your PMS of choice, take your vacation rental business to the next level.

To learn how to add a nightly fee, go to our homepage and choose your PMS logo of choice.

Sign Up Today.

Add your vacation rental property to receive instant coverage for you and your guests.

Our flexible subscription model allows you to start, pause, restart, or cancel at any time, making it easier than ever for short term vacation rental owners in California to insure their properties—without paying more than is needed.

Want to learn more about how InsuraGuest can help you? Contact us today for a free demo. Our team will gladly guide you through the benefits of InsuraGuest and show how our vacation rental insurance can improve the safety and security of your California short term vacation rental property.

Why wait? Add your short term vacation rental property today and enjoy instant coverage.

Why wait? Add your California vacation rental property today and enjoy instant coverage.

The Best Vacation Rental Insurance in California

Summary:

-

Vacation rental insurance simplified

-

The BEST short term vacation rental property insurance in California

-

Lower your homeowners insurance costs

-

Coverage for bodily injury to guests

-

Coverage for property damage & contents

-

$69/mo for $10,000 coverage

-

$99/mo for $25,000 coverage

-

No contract, cancel any time

-

Only pay for coverage when you need it

-

Let guests help pay for coverage

-

More profit to the bottom line

-

Works with your favorite property management system

Let's talk.

Contact us for a free, friendly, no-obligation consultation to help you decide if this is right for you.